Open Enrollment 2024

It’s October, which means Open Enrollment for most of you! It’s that time of year when you look at all the health insurance options for your family and stress out over which one to pick. Let me give you some thoughts about this and offer my advice. (I’m not an insurance broker! Just a doctor with insurance and admin experience… so please keep that in mind!)

TL;DR: For most people, get a high deductible health plan with a Health Savings Account. Maximize your contribution to the Health Savings Account and never touch it if possible!

Picking a health plan can be very complicated. There are lots of factors to consider, and lots of “what-ifs.” To pick a health plan, think about these factors.

Network. What doctors are included in the plan.

Deductible. How much you have pay out of pocket before the full insurance benefit starts. Once you’ve spent this amount, we say your “deductible has been met.”

Copay. The amount you’ll pay for certain services even before your deductible is met.

Coinsurance. The amount you’ll pay for services before your deductible is met if there is no copay listed.

Out of pocket max. The most you’ll have to pay in a year but NOT counting your premium! (Very important! Some people think this includes the premium amount but it does not — it only includes what you spend on medical care!)

Premium (or your contribution). The actual monthly amount you’ll pay for insurance. Again, you’ll pay this amount in addition to any medical expenses you rack up.

Once you’ve gathered this info, you should do a little experiment. First, consider what you are LIKELY to pay for the year based on your normal healthcare usage. Then, consider the WORST CASE for the year, like if things just go to hell and you have some major health concerns.

Looking at plans on healthcare.gov

First, I’m going to show you some real examples of plans on healthcare.gov (aka, “The Exchange.”) Skip down a bit to see what I think of plans from your employer.

Here’s an example of a real life health plan from healthcare.gov for me, a 50 year old nonsmoker living in St. Louis County. This happens to be the lowest cost plan available that allows for a Health Savings Account.

Sample screen shot of an Ambetter plan with a $527.81/month premium and $7,250 deductible/out-of-pocket maximum.

How on earth do we read this?

First, to see what doctors are included, you’ll need to click on the link that says “Choice Bronze HSA” and follow a few dropdown menus (you can’t do that here because this is just a screenshot!)

Then we can look at the financial info about this plan.

Deductible: $7250

Copay: None (you’ll pay the full price for everything until you meet your deductible)

Coinsurance: Again, none (you’ll pay full price until you meet your deductible)

Out of pocket max: $7,250

Premium: $527.81 per month

Here’s another one — see if you can figure out what’s going on with this one!

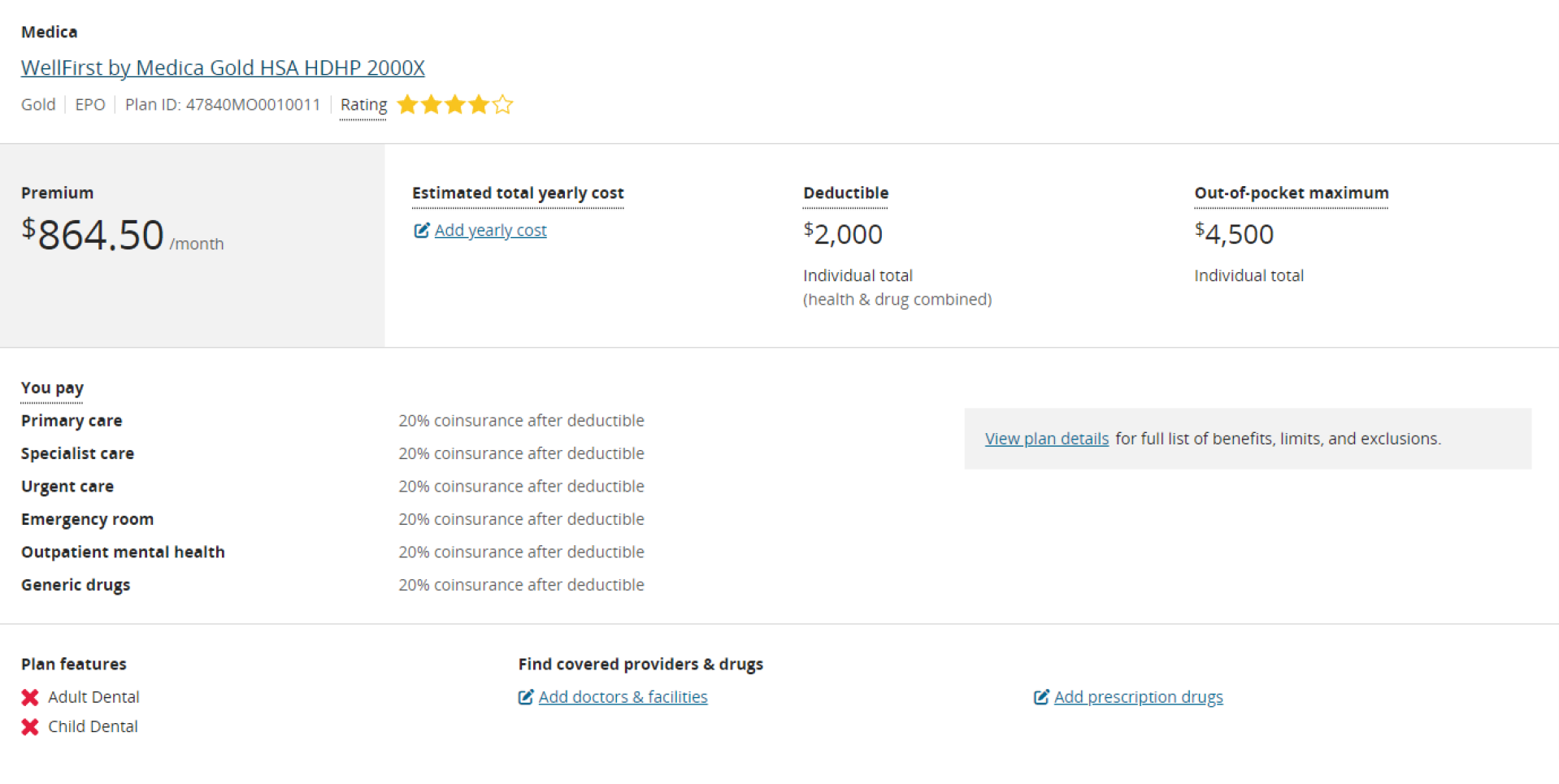

Sample screen shot of a Medica plan with a $864.50/month premium and $2,000 deductible and a $4,500 out-of-pocket maximum.

In this case, you pay more in premium, but the deductible is a lot lower. There’s also a copay listed for most services. After paying the deductible, you’ll pay only 20% of the costs for most things.

It might seem that the second plan is better, or at least less risky. But that’s not the case. The second plan is in almost every circumstance worse. Again, you can just trust me on this, or you can follow along as I show you the math.

Warning: We are about to do a lot of math. It’s hard to follow along, no matter how simple I try to make it. But here’s my best effort! If you want to skip it, just trust me, and go down to the part of this article that says “HSA.”

The first thing I do when looking at plans is to add up the total premium amount for the entire year. You just take the premium amount and multiply by 12. So we can start to make a table to compare the various plans, like this.

Plan Name |

Monthly premium |

Total annual premium |

Most Likely |

Worst Case |

|---|---|---|---|---|

Ambetter Choice |

$527.81 |

$6,334 |

||

Medica WellFirst |

$864.50 |

$10,374 |

Now we are going to make up a couple of scenarios. One is the “most likely” scenario, or what I think I’ll pay through the year. The other is the “worst case” scenario, which is where I see what happens if it all goes to hell.

Plan Name |

Monthly premium |

Total annual premium |

Most likely |

Worst case |

|---|---|---|---|---|

Ambetter Choice |

$527.81 |

$6,334 |

||

Medica WellFirst |

$864.50 |

$10,374 |

I’m going to pretend that I’m pretty healthy and I have just a couple of doctor visits each year. They cost $150 each. I’ve also got a therapist that I see twice a month for $120. So if I didn’t have insurance, I’d be paying $1,440 to my therapist per year, and $300 to my doctor per year. I’m also a bit accident prone, so I go to the ER about once a year, and that costs me $1,500, let’s say.

Total expected cost: $3,240 per year

The Ambetter plan has a $7,250 deductible. I’m not hitting that, so I have to pay the full amount. That means I can just add $3,240 to the annual premium, and that gives me $9,574.

Plan Name |

Monthly premium |

Total annual premium |

Most likely |

Worst case |

|---|---|---|---|---|

Ambetter Choice |

$527.81 |

$6,334 |

$9,574 |

|

Medica WellFirst |

$864.50 |

$10,374 |

The Medica plan has a $2000 deductible. I subtract the deductible from the total expected cost.

Total expected cost: |

$3,240 |

Minus deductible: |

$2,000 |

Equals: |

$1,240 |

I have to pay $2,000 to meet my deductible, and then I have to pay 20% of what’s left.

$1,240 x 20% = $248

Total I pay: $2,000 + $248 = $2,248

Now I just add that amount to the annual premium.

Plan Name |

Monthly premium |

Total annual premium |

Most likely |

Worst case |

|---|---|---|---|---|

Ambetter Choice |

$527.81 |

$6,334 |

$9,574 |

|

Medica WellFirst |

$864.50 |

$10,374 |

$12,622 |

So for my “most likely” case, the Ambetter plan is better, even though the deductible is much worse.

What about worst case? That’s much easier. I just assume I have to pay the full out of pocket maximum in addition to the annual premium. I add those together and get the worst case amount.

Plan Name |

Monthly premium |

Total annual premium |

Most likely |

Worst case |

|---|---|---|---|---|

Ambetter Choice |

$527.81 |

$6,334 |

$9,574 |

$13,584 |

Medica WellFirst |

$864.50 |

$10,374 |

$12,622 |

$14,874 |

So comparing these two plans, I’d pick the Ambetter Choice plan.

This is what you’ll find in most of these cases. The higher deductible plans are usually better deals. That’s because of the way the plans are priced by insurance actuaries, and how they look at risk, and it’s all above my head.

What if you get your insurance from your employer?

Most of you reading this get your insurance from your employer. And that’s a different ball of wax, because your employer is probably paying a LOT of the premium cost for your plan. You might only need to pay $100 for your health insurance in a month, or nothing at all! But the employer is still paying $600 per person covered, or more.

Employers really over-complicate health insurance. They’ll do all sorts of things to incentivize you to pick one provider or another, or to use their wellness services, or not go to the ER. But in the end, you still need to do the same math as you would in the examples I described above. And in most cases, a high deductible plan is still usually the best choice. I don’t really know why this is, and it’s not always true — but most of the time, it is. It’s still probably worth it to math out the possibilities, because sometimes you’ll find an employer who has some health plan that just pays for everything — low premium (or none!), no deductible, $5 copays for everything, and so on. If you’ve got one of those choices, obviously take it.

But if you’re pressed for time or just don’t want to think about it, pick the one with the highest deductible (which will also probably be the one with the lowest monthly contribution) and call it a day.

HSA (the Health Savings Account)

The HSA is the best thing that exists in health insurance. If you have the chance to get one, you should. And you should put as much money in it as they let you. And you should leave it alone and never ever use it unless you have to.

So as you’re looking at the info above and thinking about getting health insurance, you realize that you’re sort of screwed. You’re going to end up paying a lot of money out of pocket every year, even with good insurance.

So here’s what I think you should do. Go ahead and get insurance, and get the plan with the highest deductible (and probably lowest premium) that you can. Plan to just pay most of your medical expenses out of pocket, because your insurance simply won’t pick up very much.

But put money in that HSA.

If you’re with an employer, you’ll hopefully be paying $100-$300 per month for insurance (thinking of just you — obviously more if you’re covering the whole family). And you’ll likely spend $2,000-$3,000 per year in prescription meds, therapy, doctor visits, ER visits, and so on. Just budget for that and pay for it as best you can, because it’s probably going to be under your deductible.

If you end up in a bad situation, like you really do get in a car wreck or wind up with cancer and have expensive hospitalizations, then you can pull money out of the HSA and use that to cover the deductible amount. And the next year, you can make different choices with your insurance plan knowing that your overall expense will look different.

Why am I so big on the HSA?

Because the HSA is the only thing in this country that’s triple tax-deferred. What does that mean? It means money you put in the HSA:

Goes into your HSA before you pay taxes on it (it’s pre-tax money!)

Can be invested, and the amount it grows is tax-free

Can be withdrawn, and it’s tax-free when you take it out so long as you use it for healthcare expenses

What’s more, you can keep your HSA forever, and it travels with you if you leave your job. It is your money, and it keeps growing as long as it stays in your investment accounts.

The average American winds up paying $150,000 in out of pocket medical expenses after turning 65, even with Medicare. It is easy to build up $150,000 in an HSA over a lifetime of work. Once you get to $150,000 in the HSA, then stop putting money in it.

You can put $4,300 per year in your individual HSA in 2025 (or $8,550 for a family). If you get paid every two weeks, that’s $165 per paycheck (pretax!) Assuming you get 5% return (which is pretty low by most estimates) you’ll have $150,000 in that account in just over 20 years.

Now there’s one thing about an HSA that is a bit of a bummer — you can only contribute to one if your health plan deductible is at least $1,650 and your out of pocket maximum is no more than $8,300 (the numbers are a bit higher if you’re paying for the family). So if your employer is giving you a sweetheart plan with a $500 deductible (almost unheard of these days) you’re out of luck.

So again:

For most people, a high deductible health plan with an HSA is the best choice!